I looked up “Setup Zelle” on the day my buddy requested me to pay her back right away so we could have supper. Waiting for bank transfers felt too slow, and carrying cash was not an option. I learned how simple it was to set up Zelle at that point. I sent the money and linked my account in a matter of minutes, and she immediately got it. It helped me realize that having the proper payment arrangement makes life much more convenient.

Zelle what is she?

Hello reader, Let’s take a moment to define Zelle before we go into the setup. Numerous well-known banking applications in the United States have direct integrations with the digital payment network Zelle. It enables fee-free, instantaneous money transfers between bank accounts, typically in a matter of minutes. In contrast to third-party wallets, Zelle uses your current bank account; no new account is required!

What Makes Zelle the Best Option?

1. Instant Transfers: Within minutes, money may be sent and received.

2. No Fees: You may send and receive money with Zelle without incurring any fees.

3. Bank Integration: More than 1,000 banks and credit unions are partners.

4. Simple to Use: All you need is a U.S. cellphone number or email address.

How to Configure Zelle Detailed

Zelle is quick and simple to set up. Here’s how:

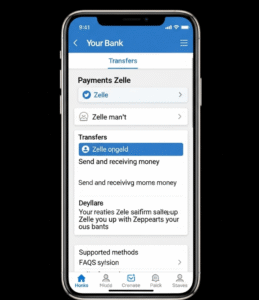

Step 1: Verify if Zelle is supported by your bank.

Zelle is integrated into the mobile banking apps of the majority of the major U.S. banks, including Capital One, Chase, Wells Fargo and Bank of America.

Advice: To find out if your bank is a partner of Zelle, go to the company’s official website.

Step 2: Download the Zelle app or the app for your bank.

- Option 1: Utilize the Mobile App for Your Bank

If your bank accepts Zelle, all you have to do is launch the app; no additional download is required. - Option 2: Utilize the Standalone Zelle App

Download the Zelle app from Google Play (Android) or the App Store (iOS) if your bank does not offer it.

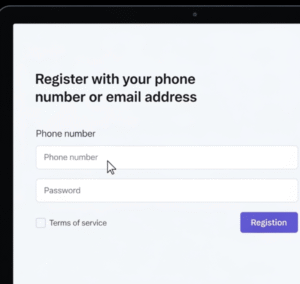

Step 3: Register with your phone number or email address

- Launch the Zelle app or the app for your bank.

- Look for “Zelle” or “Send Money with Zelle.”

- To enroll, adhere to the instructions.

- Enter your email address or mobile number in the United States.

- Connect the bank account of your choice.People will send you money if you use a phone number or email that you frequently check.

Step 4: Confirm Your Details

To confirm your contact information, you might get a one-time code over email or text message. To finish your enrollment, enter this code.

Step 5: Transfer Funds

To Transfer Funds:

- Click “Send Money.”

- Select a contact or input their phone number or email address.

- After entering the amount, click “Send.”To Get Cash:

- Provide the sender with your U.S. mobile number or email address associated with Zelle.

- If necessary, accept the payment; many institutions automatically deposit it.

Advice for Using Zelle Safely

- Send Only to Reliable Individuals: Money is lost as soon as it is sent. There is no buyer protection on Zelle.

- Verify Details: Verify that the phone number or email address you entered is correct.

- Make sure your banking app is secure by using strong passwords.

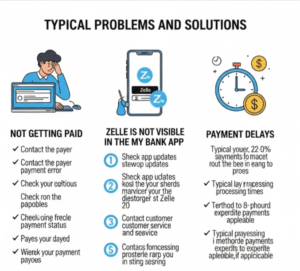

Typical Problems and Solutions

1. Not Getting Paid:

Make sure Zelle has linked and validated your email address or mobile number.

2. Zelle is not visible in the My Bank app:

Verify whether Zelle is accepted by your bank; if not, utilize the stand-alone app.

3. Payment Delays: While the majority of Zelle transfers happen instantly, if the recipient is not enrolled yet, some can take one to three business days.

Concluding remarks

It only takes a few minutes to set up Zelle, which spares you from having to write cheques or make numerous journeys to the ATM. Zelle facilitates quick and easy financial transactions, whether you are paying friends, relatives & dividing group expenses.

So why wait, My Friend? Grab your phone, sign up for Zelle and enjoy the convenience of immediate money transactions.

Read more: Google Alert Setup ❤️

FAQ’S:

what is Zelle?

Sending and receiving money directly between U.S. bank accounts is quick, easy, and safe using Zelle.

Is Zelle a download required?

You do not need to download anything extra if Zelle is available in your bank’s app. Download the Zelle app separately if not.

What is required for Zelle enrollment?

valid email address or U.S. cell number, a U.S. bank account, and the Zelle or your bank’s app are required.

Is Zelle free to use?

Indeed! There are no fees associated with sending or receiving money using Zelle.

Is Zelle available abroad?

Not at all. Only bank accounts situated in the United States are accepted by Zelle.

Zelle Transfer Time & Fee Calculator

Calculate exactly when your money will arrive and how much you’ll save compared to other services.

Enter Transfer Details

This is the most important factor for transfer speed[citation:4][citation:5][citation:9].

Yes, they’re enrolled

They use Zelle through their bank

No, not enrolled

They’ll need to sign up first

I’m not sure

Calculate both scenarios

Did you know? Zelle has phased out its standalone app. New users must enroll through one of the 2,300+ participating banks or credit unions in the U.S.[citation:5][citation:7][citation:8]

Your Calculation Results

Critical Safety Reminder

Zelle payments are typically irreversible once sent to an enrolled recipient[citation:5]. Only send money to people you know and trust. Zelle does not offer purchase protection for goods or services[citation:4][citation:6].

Zelle vs. Other Services

| Service | Typical Speed | Fees to Send | Best For |

|---|---|---|---|

| Zelle | Minutes to 3 days[citation:4][citation:9] | FREE[citation:4][citation:5] | Trusted friends & family |

| Venmo/Cash App | Instant (fee) or 1-3 days (free) | 3% for credit cards | Social payments |

| Bank Wire | 1-2 business days | $15-$50 per transfer | Large, secure transfers |

Leave a Reply